It was a positive start to the week for the Australian share market which rallied on Monday as investors raised their bets that the Federal Reserve and other central banks had finished raising interest rates. Source

Economy

For anyone planning a trip to the US in the coming months, the sudden and substantial increase in the Australian dollar will come as welcome news. Source

Australia, the United Kingdom and America will deploy advanced artificial intelligence to track and surveil submarines in the Asia-Pacific as part of a larger AUKUS-led collaboration to contain threats to democracies in the region, including from a rising China. Source

A top weapons manufacturer has argued that Australia’s defence industry is far too reliant on the UK and the US for munitions, declaring that the government must overhaul its defence strategy to favour local procurement. Source

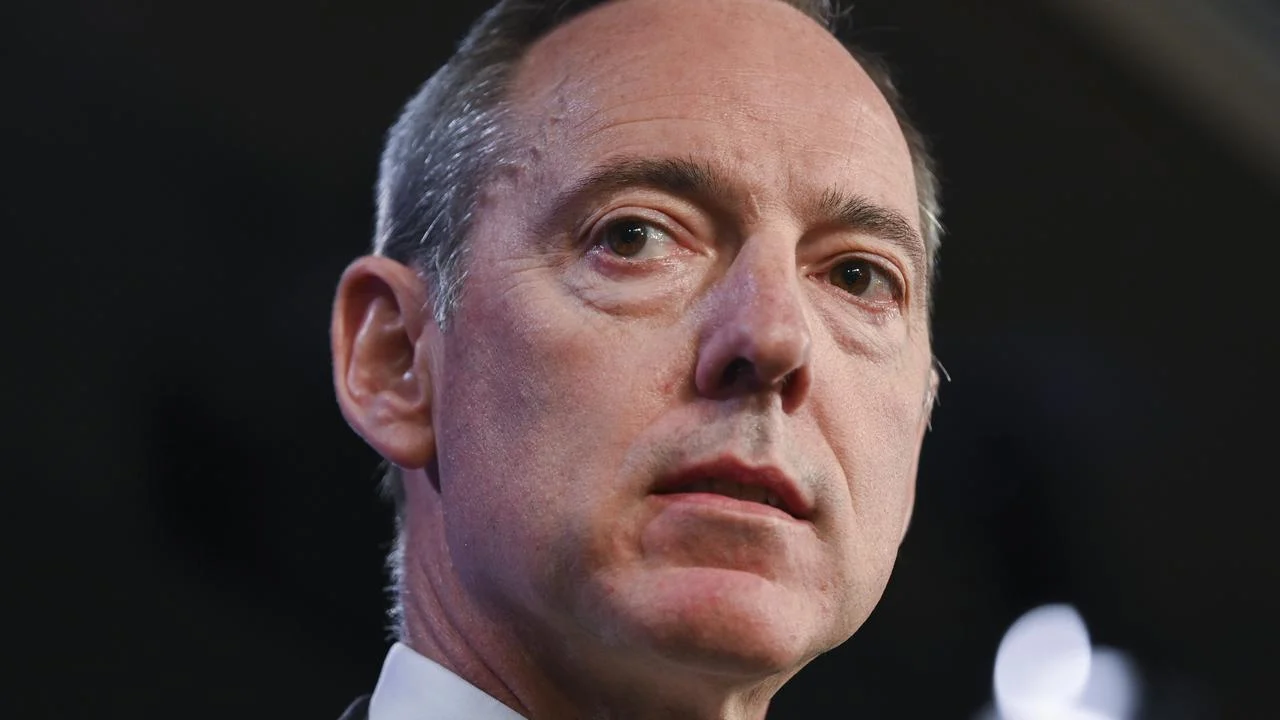

Defence Industry Minister Pat Conroy has rejected cost and transparency concerns around the federal government’s AUKUS nuclear submarine deal, arguing the program will be critical to defending Australia’s national security amid increasing military build-up and rising global tensions. Source

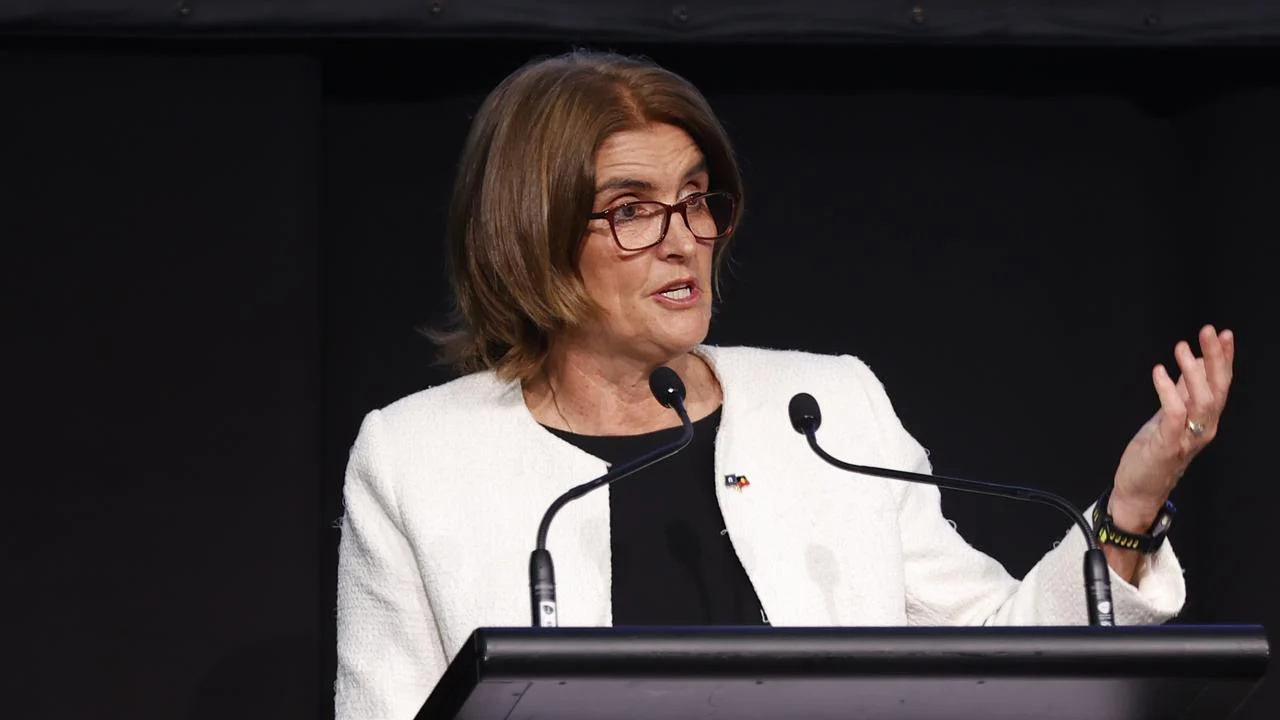

Reserve Bank governor Michele Bullock has made a frank admission, conceding borrowers are “very unhappy” with the central bank, but are coping with higher interest rates. Source

The ranks of the Reserve Bank are set to be bolstered following the appointment of a top official from UK’s central bank. Source

Hundreds of temporary visas have been issued to desperate Palestinians by the Australian government over the past few weeks as Israel continues its bombardment on Gaza, but Foreign Minister Penny Wong says the situation remains “very difficult”. Source

The Australian share market was flat on Wednesday as gains in large cap stocks were offset by falls in real estate and tech shares. Source

Delaying the Melbourne Cup Day rate hike would have risked a more aggressive increase to interest rates in the months ahead, fresh meeting minutes released by the Reserve Bank have revealed. Source

High wages growth without an uptick in productivity could trigger further inflation, Reserve Bank governor Michele Bullock has warned, as the central bank mulls a further rate hike. Source

The Australian share market rose on Tuesday as traders shrugged off the release of new Reserve Bank board minutes which showed it was prepared to hike interest rates again. Source

What does an unprecedented drought in Central America mean for Australia’s Christmas shopping baskets? We’re about to find out – with a parched Panama Canal struggling to find enough water to shuffle cargo ships between the Pacific and the Atlantic. Source

Anthony Albanese has refused to comment on US President Joe Biden calling China’s President Xi Jinping a “dictator” but welcomed renewed military dialogue between the global powers. Source

There has been a huge 6 per cent daily increase in the price Bitcoin, with the cryptocurrency edging closer to the $58,000 mark (US$38,000), following a brief dip below $53,900 on Tuesday. Source

Australia’s lucrative $3bn subscription video on demand market is confronting a new headwind from cost-conscious young Australians, with four in 10 Gen Zs cancelling a streaming service in the past three months. Source

The parent company of Optus has broken its silence on last week’s nationwide blackout, denying responsibility for the communications wipe-out that alienated millions of Australians and put future government contracts under review. Source

US officials have cleared the streets of San Francisco’s downtown area of drug addicts, dealers and homeless people ahead of a visit by Chinese President Xi Jinping, sparking outrage from long-suffering residents in the crime-plagued city. Source

Australia’s biggest bank has hit Australian homeowners with an interest rate increase, the last of the Big Four to follow the Reserve Bank of Australia’s Melbourne Cup hike on Tuesday. Source

Treasurer Jim Chalmers has marked out a spike in global oil prices as a key reason why Australian homeowners will fork out more money on their mortgages. Source